Luxury Bazaar

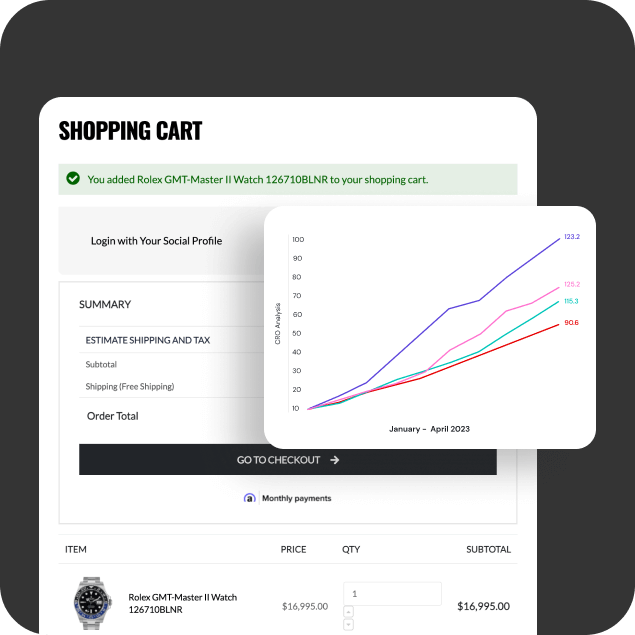

The Luxury Bazaar company has been selling branded/luxury watches and accessories since 2001. They are a reliable dealer of both new and used cars, watches of such brands as Rolex, Audemars Piguet, Patek Philippe, Vacheron Constantin and others. Their main task is to find the best and rare watches and jewelry at the best price in order to offer their customers the widest range.

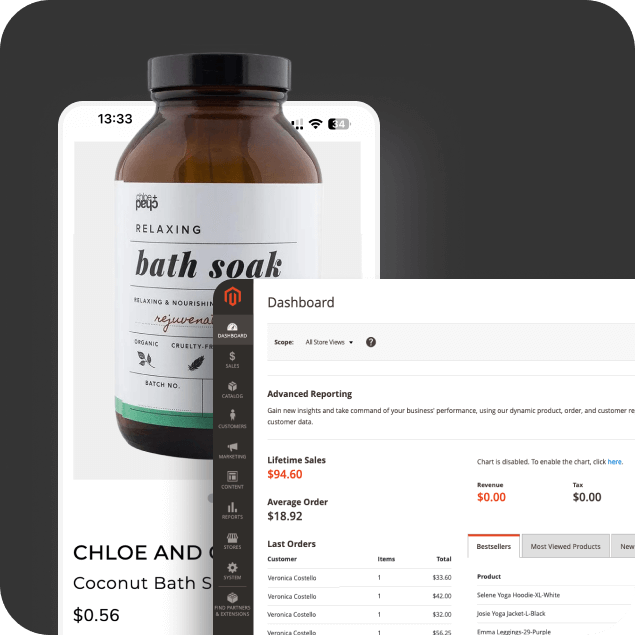

The client approached Paspartoo Agency to complete the development of their initial-stage website. Since Luxury Bazaar deals with high-value products, it is crucial to maintain meticulous records for every item. Despite having identical watches in stock, each piece had a unique part number/barcode. This required developing functionality to differentiate products with the same SKU in Magento 2 and synchronizing them with the Quickbooks Desktop system.

Our team created a custom entity as a sub-product within the main product, enabling distinct quantity, cost, and attributes. We modified the Magenest Quickbooks Desktop module to seamlessly integrate with this custom entity. To maintain up-to-date product quantities and track sales, we developed a custom module for importing Quickbooks Desktop-generated reports into Magento 2 XLSX format. Additionally, we enhanced the front-end to give the site a modern and stylish appearance.